This page contains opinionated responses to some basic questions about Bitcoin, with a focus on Bitcoin beginners. Once you get your feet wet, there are plenty of more advanced resources.

Content

If there was no money, what would you use as money?

Satoshi’s Thought Experiment

What are some simple ways to think about Bitcoin?

What is Bitcoin?

Why is Bitcoin disruptive technology/money?

How Bitcoin works? ELI5.

Why is Bitcoin better than fiat money or gold?

Should I buy Bitcoin? And how much? It seems low/high currently. It is so volatile.

Where do I buy Bitcoin?

What is your price prediction?

Blockchain is just digital data and numbers. I can just duplicate my wallet file or spend the same Bitcoin twice.

It is open source code and data. Anybody can copy it. How can it be scarce?

Should I buy in Ethereum?

Bitcoin doesn’t scale – altcoin X has much better technology. Should I buy X?

Is it legal? Are criminals using it?

Bitcoin is using as much energy as {{insert coutry}}!

Should I be mining Bitcoin?

Should I be trading Bitcoin?

If there was no money, what would you use as money?

Stop reading and think about this. Here’s an example. Can we use bananas as money? Using bananas as money would have its own set of problems. Here are some reasons why it’s not a good idea:

- Bananas are perishable and have a short shelf life, which means they can spoil quickly and lose their value.

- It would be difficult to store and transport bananas because they are delicate and prone to bruising and damage.

- Bananas come in different sizes and quality, which can make it challenging to determine their worth and value.

- They are not a universal currency and may not be accepted as payment everywhere, making it challenging to use them as money.

- Bananas may not be a practical form of currency for larger purchases such as cars or homes, as the number of bananas required to make such purchases would be impractical and difficult to manage.

- If you save bananas for future use, they can become overripe and lose their value.

- Bananas may attract pests and insects, making them more difficult to store and handle.

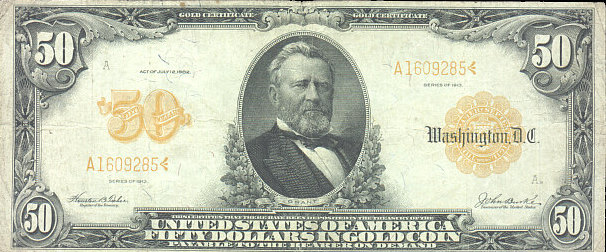

If you tried the exercise multiple times, you may have found that gold or silver makes good money. Gold has been used as currency for thousands of years because it is scarce, portable, divisible, durable, and fungible. However, storing, protecting, and verifying gold can be difficult and risky. That’s why humans created paper money, which was initially backed by gold or silver. However, now most paper money is fiat money, meaning it has no intrinsic value and is not backed by any asset. The value of fiat money comes from the government and society’s belief in it. Fiat money has benefits, but its biggest problem is sustainability. History is full of failed fiat currencies due to hyperinflation, and only time will tell if it can last as long as gold. For example, the U.S. left the gold standard in 1971. It is still a young experiment, and we’ll see if it will be able to hold for centuries like gold did.

There is a better money, called Bitcoin!

Satoshi’s Thought Experiment

“As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties:

- boring grey in colour

- not a good conductor of electricity

- not particularly strong, but not ductile or easily malleable either

- not useful for any practical or ornamental purpose

and one special, magical property:

- can be transported over a communications channel

If it somehow acquired any value at all for whatever reason, then anyone wanting to transfer wealth over a long distance could buy some, transmit it, and have the recipient sell it.”

What are some simple ways to think about Bitcoin?

Bitcoin is property rights for the whole world.

Bitcoin is “freedom money”.

Bitcoin is an independent system of ownership.

Bitcoin is like a game of Monopoly without a banker.

Bitcoin is cash you can email.

Bitcoin is a huge public spreadsheet of transactions that achieves worldwide consensus (sync) every 10 minutes.

Bitcoin is software eating money.

Bitcoin is insurance against human errors.

Bitcoin is leveraging the laws of math and physics.

Bitcoin is programmable money.

Bitcoin is the most secure computer network in the world.

Bitcoin is like gold or silver, precious metals; Ethereum is like copper or aluminum, industrial metals.

Technical features make Bitcoin an incredible monetary asset.

The speed of monetary assets has finally caught up with the speed of the Internet.

For the first time in history, a wealth defender has an advantage over the attacker.

You don’t own a car or a house; you own Bitcoin.

What is Bitcoin?

Bitcoin is a new type of money, running as open-source software on a peer-to-peer network. It leverages mathematics, computer science, computer software and hardware, cryptography, and energy to enforce and self regulate the rules. There is no central bank behind it; there are no CEOs, no paid engineers, no salespeople or marketing departments; there are no lawyers, laws, or courts behind it. Participants utilize it as a financial protocol to send and receive value digitally in a trustless and permissionless fashion, without a third-party intermediary. The base layer is analogous to the TCP/IP network protocol of the Internet. Companies and individuals build a new financial stack of applications on top of the base layer.

It is an entirely new concept, not easily comparable to anything invented or discovered before Bitcoin.

Why is Bitcoin disruptive technology/money?

Bitcoin is the first asset in history that nobody can take away from the owner. Every other possession can be taken away by force, laws, taxes, or inflation. Your mind, decentralization, mathematics, and energy protect your Bitcoin.

Bitcoin is permissionless – anybody can own it. You don’t have to be a member of a particular nation, religion or club, nor have much money to partake. It works well for storing small values and for storing large values. A cheap mobile device and Internet access are all you need to participate in this network. You can carry it with you wherever you go – it is freedom technology.

Nobody can censor or stop the transactions, you can send value anywhere, anytime – in the middle of the night, over the weekend, and on holidays, while minimizing the amount of trust required by any single actor.

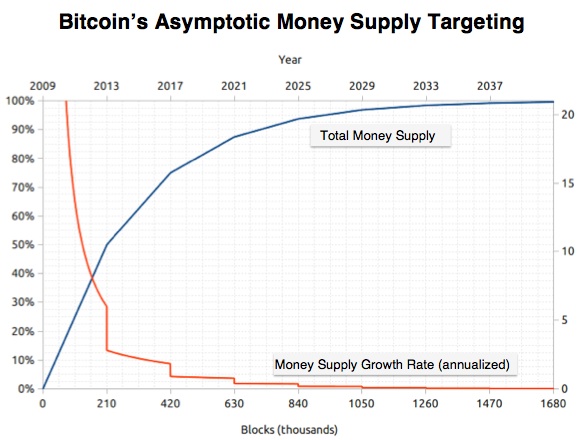

Bitcoin has a fixed supply. There will be a total of 21 million bitcoins. At the beginning of 2021, there are 18.5M+ Bitcoins in existence. The last Bitcoin will be created somewhere around year 2140. With an increase in demand for it, Bitcoin will become more and more scarce. Over an extended period, it will not lose its value through inflation. It is deflationary money.

Bitcoin separates government from money. Bitcoin is above governments; they cannot destroy it or (easily) ban it the long term, governments will use it in the future. With Bitcoin, money becomes a thing outside society’s reach or influence, almost like a force of nature, like gravity.

How Bitcoin works? ELI5.

Think of it as a massive spreadsheet of transactions, a ledger, grouped/chained in blocks – the blockchain. The columns are from, to, amount, and timestamp. It is a public distributed ledger – meaning there are many public copies of this spreadsheet. This spreadsheet runs on a software called Bitcoin Core node, on tens of thousands of computers around the World; even on inexpensive hardware, like Raspberry Pi. Anybody running the node can read all the transactions.

Adding a new block of transactions to a blockchain is a hard-earned privilege. There is another temporary sheet with pending transactions, in which everybody that owns Bitcoins can write into. It’s called the mempool. To add a new block, one must solve a hard mathematical puzzle by guessing the solution with trial and error methodology. This process, known as mining, is done by huge data-centers full of specialized computers (ASIC miners), using a lot of electricity.

Miners solve the puzzle every 10 minutes on average, packing it into a new block. The reward for their hard work is called block subsidy; currently it is 6.25BTC. In addition to subsidy, they get transaction fees from individual transactions. This process is called proof of work.

The new block is announced to the nodes over the peer-to-peer network. Nodes easily verify that the puzzle is solved and that transactions are valid – that the sender had enough balance to send and is not double-spending their coins. Once more than 50% of nodes add a new block, it becomes immutable (cannot be removed or changed).

If more miners join the mining process, they will increase the hashrate – the number of solution attempts per second. On average, they will guess the solution faster than 10 minutes.

Consequently, the Bitcoin network adjusts puzzle difficulty every 2016 blocks – in this case, it increases the difficulty. If miners leave, the hashrate will drop, so the puzzle will get easier to solve.

Roughly, every four years, block subsidy is halved. The next halving will be in 2024, and the subsidy will drop to 3.125BTC.

An increase in hashrate ensures and strengthens the network’s security. The Bitcoin network survived 10+ years without any serious hacks and currently is the most secure network in the world. Yes, some exchanges (businesses) and individual users were hacked, but not the Bitcoin network itself.

Why is Bitcoin better than fiat money or gold?

The simplest explanation is that it is very good money.

In short, it is:

- limited supply – there will be a total of 21,000,000 BTC; monetary policy and issuance is known in advance and cannot be changed

- portable – send money as easy as an email; carry it with you in your head, or a small hardware device, or piece of paper, even across the borders

- divisible – 1 BTC = 100,000,000 satoshis (like dollars and cents)

- durable – peer-to-peer copies make it impossible to destroy

- distributed across thousands of computers around the World, resistant to natural disasters or malicious organizations

- even satellites transmit Bitcoin blockchain data; soon we’ll have Bitcoin blockchain on space stations, on Moon and Mars

- censorship-resistant – everybody can use it, and no one can stop its usage

- easily verifiable – all nodes know total supply and coin distribution at all times; it cannot be counterfeited

- fungible – each Bitcoin unit is equal as any other Bitcoin unit on a network level

- programmable – modern times yearn for a modern money; it’s straightforward to write scripts that send money; also, a whole new concept is streaming money (services that will charge per view or per second spent consuming their content)

- platform with network effects – Bitcoin is a money platform at Internet speed

- money is a platform that all businesses and individuals use

- we used to transact in-person, bounded by geographical constraints and local currencies

- Bitcoin is a money platform at Internet speed

Bitcoin is often compared to gold and labeled as Digital Gold. Bitcoin is better than gold in all properties, except perhaps in fungibility. Also, gold has been used historically for thousands of years as money. Regardless, many examples in history prove that new, disruptive technology destroys traditional methods (a few instances include swords and rifles, horses and cars, telegram and telephone, oil and electric vehicles).

Bitcoin’s new supply is perfectly inelastic to its price. No matter how much Bitcoin grows or falls in price, its new supply issuance is not reacting to its price. It is baked in software and cannot be changed. Bitcoin software is improving and can change slightly, but every change requires a consensus between developers, miners, node runners, and Bitcoin owners. Bitcoin’s monetary policy is something that has never been changed and probably never will be. It is the core of what Bitcoin makes valuable, and it is agreed upon by all parties in the Bitcoin ecosystem.

The new supply of gold is mostly inelastic – with rising gold prices, gold miners spend more energy and resources to dig up additional gold and change its supply issuance.

Fiat money supply depends on economies, governments, central banks, and those who trust them. They generally increase the supply year over year, which results in higher asset prices or inflation. History is full of failed fiat money due to hyperinflation. Fiat money that has not died yet is losing purchasing power year after year. This includes the USD, mostly visible through rising prices of real estate, education, and healthcare.

All this makes Bitcoin a great store of value over time.

Should I buy Bitcoin? And how much? It seems low/high currently. It is so volatile.

Yes. It is the ultimate savings account – a store of value technology. Bitcoin as an asset is similar to scarce land and real-estate, gold, precious art, old cars, watches.

You don’t have to buy a whole bitcoin – each one is divisible into 100,000,000 satoshis. Start with a small but meaningful amount. This is different for each of us. Put a small single-digit percentage of your savings/investment portfolio into Bitcoin. Do not take debt for this first purchase.

Then, the best buying method for growing your equity is dollar-cost averaging (DCA). This means buying a small amount periodically, every day, week or month. That’s how you deal with volatility. Over long periods, five years or more, it will probably maintain and grow its value relative to other assets. Since 2009, Bitcoin is the best performing asset in the world. Let that sink in for you.

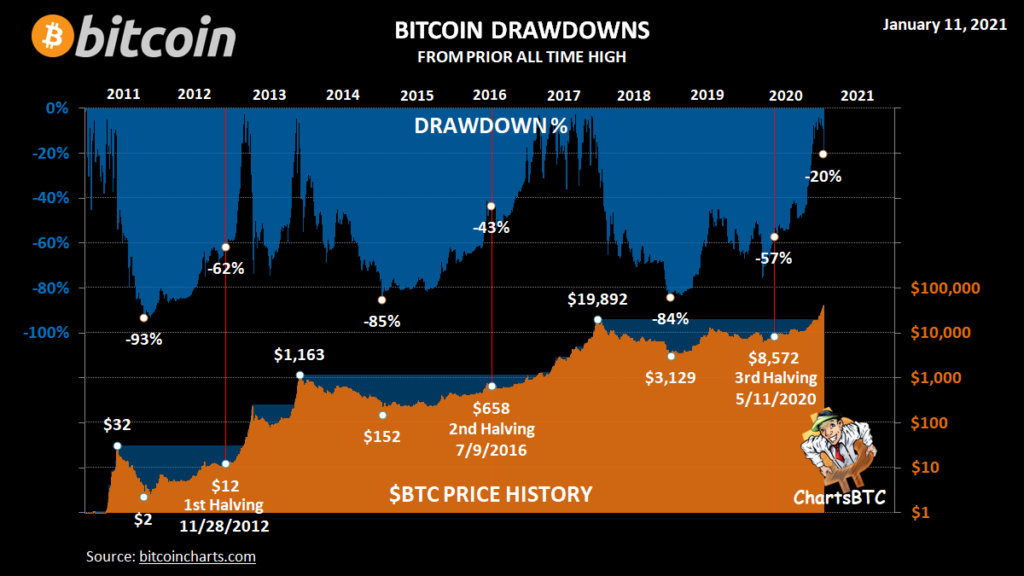

Bitcoin often dips and spikes in value. Be aware that on any day, Bitcoin prices can grow or fall as much as 30%, in a day—just HODL. This is because of the market’s (people’s) reaction to Bitcoin. Bitcoin is solid as a rock and doesn’t change and doesn’t care; its monetary policy and issuance are set in software and cannot be changed. It is still very early, and while it captures vast amounts of new value, it’s perceived value has to be volatile. Embrace the volatility and use this information to your advantage. Bitcoin is still a big asymmetric bet, it’s not “to late”.

Stay humble, stack sats!

Where do I buy Bitcoin?

Bitcoin is the first asset in history that you can truly own, self custody, and keep safe. This is done by keeping your own Bitcoin wallet and holding your own private keys or the seed phrase.

While it is encouraged to learn how to do that, it can sometimes be overwhelming for beginners. Holding your own keys gives you freedom, but it also comes with a big responsibility. If you lose the keys, you lose your bitcoins. If somebody else gets your keys, you lose your bitcoins. There is no “forgot password” functionality in Bitcoin base protocol.

Never give your keys to anyone. Never enter your keys on a computer connected to the Internet. To safe keep your keys, get a hardware wallet.

Until you learn how to self custody your bitcoins, you can buy and keep small amounts on exchanges. When choosing an exchange, check that they have a functionality that allows withdrawing bitcoins to a wallet (without selling them). Some of them are:

Services like PayPal or Revolut do not allow Bitcoin withdrawal. Do not buy there.

What is your price prediction?

Nobody knows for sure – if they tell you they now for sure, they are scamming you. All models (predictions) are wrong, but some are useful. These models can spur wild imagination and bullishness. Be careful not to rely on them for making financial decisions entirely.

A free market discovers bitcoin’s price as an equilibrium of supply and demand. One thing that makes Bitcoin different from everything else is its limited total supply, and the new supply issuance is known in advance. Like in other assets, a decrease in supply with a constant demand drives the asset’s price up. This decrease in Bitcoin’s new supply happens roughly every four years in events called halvings. In 2012 the block subsidy (a reward that miners get for solving the puzzle every 10 minutes) was cut from 50BTC to 25BTC. In 2016, it was cut to 12.5BTC, and in 2020 it was cut to 6.25BTC. So far, these halving events had a significant influence on price. A few months after halvings, the price slightly increases because the supply decreases but doesn’t dry up immediately, and the demand is relatively constant. But when the supply dries up (around six months after halving), bitcoin’s price usually starts its move up. A sharp price increase usually also spurs much attention and causes FOMO. That’s when the price shot up parabolically in the past, two times so far. During these moves, there are a bunch of price corrections by as much as 30%. But overall, these parabolic moves ended up with huge gains so far, usually more than 10X. After these wild price appreciations, the end of the bull cycle happened, and the Bitcoin price has crashed by around 85% – but was still much higher than previous highs. That’s why long term HODLers win in the long term.

In summary, Bitcoin had a fractal price chart so far, with roughly four years periods and significant volatility. It is the best performing asset in the last ten years. Nobody knows if it is going to repeat this pattern in the future. It is possible.

Blockchain is just digital data and numbers. I can just duplicate my wallet file or spend the same Bitcoin twice.

No. That is Bitcoin’s greatest invention. With mining, proof of work, and distributed consensus mechanism, Satoshi invented digital scarcity.

It is open source code and data. Anybody can copy it. How can it be scarce?

As with all money, Bitcoin has value because people trust it has value. Fiat money is not backed by a physical commodity like gold or silver – it is backed by nations’ stability, people, law, economy, and military power. If people lose trust in a nation, their money becomes worthless.

Bitcoin value is also a trust system – as noted above, it builds trust on math, software, and physics. But also, there is a vast ecosystem built on top of Bitcoin network. The world’s best engineers and mathematicians work on improving Bitcoin’s software. There are plenty of miners that secure the network – their hardware is mostly useless for any other purpose. There are a lot of businesses that use the Bitcoin network. Lastly, there are plenty of individuals that transact on this network. It relies on market incentives. Being the first in the space and without the pre-mine for Satoshi (immaculate inception), it gained a massive following and cemented its position that can hardly be overthrown. Satoshi does own a lot of Bitcoin that he mined early on, but this coins haven’t been used or moved to this date.

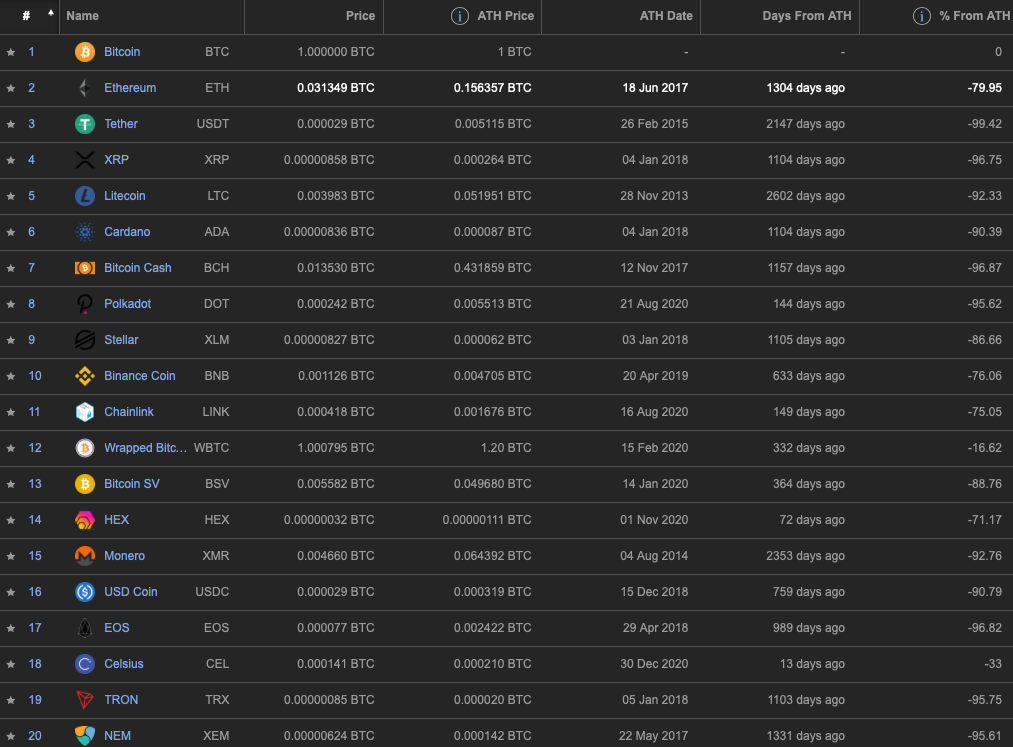

In 2017, there was a huge debate over the block size. There were two sides in this debate, and they couldn’t reach an agreement. The software and data (blockchain) were forked (copied), and a new cryptocurrency called Bitcoin Cash was created out of thin air, in addition to regular Bitcoin. All the balances were copied. If you owned 1BTC, you suddenly owned also 1BCH on a different blockchain. The Bitcoin Cash software was updated to uphold the new rules, and both blockchains were operating separately since that moment. Some developers, miners, and businesses moved to work on the Bitcoin Cash network.

Fast forward to 2022 – the market has chosen Bitcoin as a winner. Despite a huge effort from people and businesses involved in Bitcoin Cash, current exchange rate is 1BCH = 0.005BTC and BCH is trending downwards in BTC value. Bitcoin Cash was then further forked in 2018 to Bitcoin SV. Also, trending downward in Bitcoin terms. Don’t buy Bitcoin Cash or Bitcoin SV just because they are cheaper Bitcoin – they are not Bitcoin.

There are over 8000 altcoins – also called cryptocurrencies or crypto or virtual currencies. Some of them are Bitcoin forks, like Litecoin. Some are funny like Dogecoin. Some use blockchain, some have smart contracts, some claim to have better and faster technology than Bitcoin. None of them are decentralized like Bitcoin is. Most of them (more than 99%) will never have real-world usage, application, and value. Over time, their value is trending to zero denominated in BTC terms. They are often scams and hazardous investments and are used by their owners and inside traders to fool naive investors.

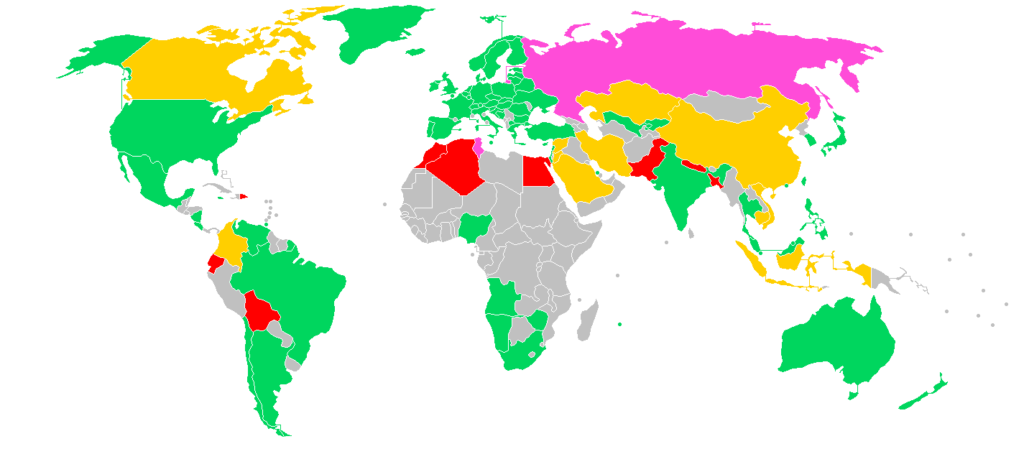

Source: coinpaprika.com in Jan 2021

Should I buy in Ethereum?

This page isn’t about Ethereum, but since you ask – Bitcoin and Ethereum are different assets. Ethereum is not sound money. Try to understand Bitcoin and its value proposition first. And then, try to understand all the technical challenges that Ethereum is facing. You can buy a little to investigate and play with it.

Ethereum is the second-largest cryptocurrency by total market cap. It has a big developer and business ecosystem. Its big promise is the ability to run (complex) smart contracts. The Ethereum Virtual Machine (EVM) can execute Turing-complete scripts and run decentralized applications. It is a great innovation and is interesting from a technical perspective, and opens many possibilities for real-world applications. Its marketing is very good.

There are a few interesting Ethereum applications/ideas like ICOs via ERC20 token standard, stable coins, non-fungible tokens (NFTs), and decentralized finance (DeFi).

However, compared to Bitcoin, it is a vastly more complex system and changing protocol. Since all nodes are calculating/evaluating complex smart contracts in real-time, Ethereum has a performance issue. It cannot scale at its current rendition. There are many proposed solutions to this problem. One of them is the move from a proof of work system to a proof of stake. Proof of stake system was never deployed on such a big and valuable ecosystem.

Another challenge is that Ethereum is not entirely decentralized. Ethereum node is difficult to run, even on great hardware – even some big exchanges don’t run Ethereum nodes. A lot of Ethereum ecosystem depends on centralized services like Infura. Also, Ethereum had a huge pre-mine event giving 70% of all ETH to its founders. A blockchain technology without a decentralization aspect makes very little sense. It is slow and expensive.

So, Ethereum is still one big experiment, still in alpha. Tread very carefully.

Bitcoin doesn’t scale – altcoin X has much better technology. Should I buy X?

No, you are probably being scammed and will get burned. Buy it only if you want to gamble for fun or education.

Bitcoin is not “crypto” and Bitcoin is not “blockchain”. Cryptography and blockchain are building blocks of Bitcoin. A crucial aspect of Bitcoin that every other altcoin that wants to be money misses is decentralization. It is possible that blockchain could be used for other purposes in the future, but so far it has been proven only for money.

This is not just a blinding maximalist view – it is a rationalist view from many people burned by altcoins that have been in this space for a long time. Technology innovation is great and encouraged, but we need to differentiate between Bitcoin and other cryptocurrencies. Bitcoin is money; everything else is just an aspiring technology. We need to treat it like such.

Bitcoin’s technology is great, a true innovation. A base layer is deliberately safe, slow, and simple. This is a feature and a design choice. Bitcoin’s conservative approach to development, thorough code reviews, very few new features, and BIPs are necessary. All this is preventing future problems and hacks. It safeguards our money.

If you are concerned about transaction speed on the base layer, think about value transferred per second. Bitcoin is by far the best payment method by this metric.

The base protocol layer is set, it is backward compatible with older nodes, and it will not change much in the future. The biggest feature to be activated in the Bitcoin base layer will be the taproot project, which will enhance the Bitcoin network’s privacy. Most other innovations are happening on upper layers with technologies like Lightning Network, Liquid Network, DLC (Discreet Log Contracts). Lightning network enables instant and scalable world wide transactions, in Bitcoins.

BTW, the Bitcoin base layer also has smart contract capabilities with an elementary instruction set, whose execution scales and is safe.

Is it legal? Are criminals using it?

It is legal in most countries around the World, certainly in modern democracies. It is just computer code and data, zeroes and ones – like free speech. If/when your government bans it, it is time to question your government. The governments that made it illegal are having a hard time enforcing these laws. These countries will lose significant wealth and tax revenues and will stay back in development compared to countries that innovate on it.

Bitcoin exchanges in the US are well regulated and compliant with KYC and AML regulations.

For tax purposes in the US, Bitcoin is treated as property. Meaning, you’ll invoke a capital gain or loss once you sell Bitcoin or buy something with it.

Criminals use Bitcoin, dollars, banks, the Internet, cars, pants, and various other things. Often, the asset itself is not the problem – it is how you use the asset. Banning new technology just because early-adopting criminals use it is counter productive. Imagine banning cars only because bank robbers use cars to escape. It is very unwise to use Bitcoin for criminal activity. Remember, Bitcoin is a public ledger of transactions.

Bitcoin is using as much energy as {{insert coutry}}!

What is the problem with using energy? Energy harvesting and usage contributed to the greatest developments of the human race, countries, science, medicine, and culture. Increased energy usage is a sign of an advanced civilization.

Are you may be concerned with energy production from polluting air sources? This is a different question, and the burden of answering it shouldn’t be put on Bitcoin miners. They are allowed to buy energy in a free market like everybody else, like you are.

Bitcoin mining is a highly competitive game. That’s why miners are trying to use the cheapest forms of energy. Most energy for mining comes from renewable sources or the energy that would otherwise be wasted anyway. The most common source currently is hydroelectric power. In fact, the Bitcoin mining industry’s demand for cheap energy will further help finance, research, and develop renewable energy sources.

Should I be mining Bitcoin?

No! Are you kidding? You are reading a quick intro to Bitcoin and thinking of going into a very competitive field. It is filled with industry experts with operational knowledge, supply-chains connections, and access to cheap energy. First, learn deeply what Bitcoin is and how it works.

Buy piece of a bitcoin instead of that miner machine you would have bought.

Should I be trading Bitcoin?

No! Are you kidding? Similar as above. You know very little about the asset and you will lose money if you are trading. Just buy and HODL!